Insurance Services

At Marvellous Wealth, we help you build a strong retirement foundation through Systematic Investment Plans (SIPs) in the National Pension System (NPS).

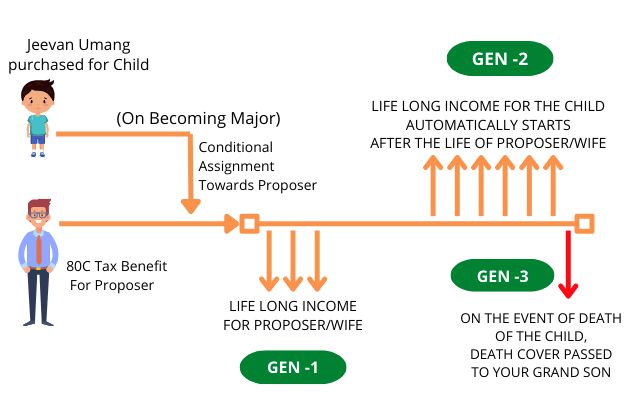

Umang Whole Life Insurance (Umang 3G – LIC of India)

The Umang 3G plan by LIC is a unique three-generation protection and income scheme. It is designed to provide lifetime guaranteed income, life cover, and wealth transfer benefits.

- The plan is purchased in the child’s name (Life Assured), with the parent as the proposer.

- Premiums are paid for 15 years only.

- After the premium term, the policy provides a guaranteed tax-free income of ₹94,000 per year, payable for the lifetime of the insured.

- In case of the proposer’s death, the child (Life Assured) immediately starts receiving the yearly income.

- On the death of the Life Assured, the accumulated wealth is passed on to the next generation (grandchildren).

- The plan also allows encashment or loan facility in case of financial needs.

This scheme provides a balance of regular income, life cover, and long-term wealth creation, ensuring financial security across three generations.

LIC Umang 3G – Benefit Overview

LIC Umang 3G offers lifetime annual income of ₹94,000 after 15 years of premium, along with growing life cover, tax savings, and an expected maturity of ₹1.55 Cr at age 80—ensuring protection, income, and wealth creation for your family.

Benefits Illustration

- Total Premium Paid (15 years): ₹14,89,162

- Total Returns (Expected): ₹2,11,97,000

- Maturity Amount (Age 80): ₹1,55,57,000

- Tax Saved (in 15 years @30% slab): ₹4,62,450

- Net Premium Paid (after tax savings): ₹10,26,712

Survival / Income Benefits

- From Age 20 onwards → ₹94,000 annually for life

- Final Addition Bonus (FAB @ Age 80): ₹1,09,98,000

- Expected Total Benefit at Age 80: ₹1,55,57,000 + yearly incomes

Coverage & Premium Details

- Normal Coverage: Increases yearly from ₹96,951 at age 5 to over ₹1.55 Cr by age 79.

- First-Year Premium: ₹1,01,314 (Yearly mode, incl. GST 4.5%)

- Subsequent Premiums (Yearly): ₹99,132 (incl. GST 2.25%) Other modes available: Half-Yearly, Quarterly, Monthly.

Start Your Journey

Fill out the form to unlock personalized wealth management solutions tailored to your unique financial goals.

Reach Out to Us

Contact us for inquiries, bookings, or support. We’re here to help you achieve your financial goals.

Address

Room 112, 2-A/3, S/F Front Side, Kundan Mansion, Asaf Ali Road, Turkman Gate, New Delhi – 110002

marvellouswealthmanagement@gmail.com

Office Timing

Monday to Friday: 10:00 AM – 5:00 PM

Empowering clients through tailored financial solutions and dedicated support.

© Marvellous Wealth Management (OPC)Pvt.Ltd 2025